Scoring commercial real estate for location risk reduction

"Location, location, location" is the number one rule in real estate, and often the most underestimated. Big data from connected devices and location-based apps provides insights on status quo and future trends of locations. [PropLocation]

Habidatum transforms this data into synthetic metrics in order to inform location-specific decisions in real estate and urban planning. We continue the set of publications describing our approach to location and its growing importance to property values estimation and revenue forecasting in real estate.

This time the focus is location risk, which is an essential component for measuring an asset’s potential liquidity in its respective location – the easiness to buy, sell, or re-profile it in the future.

Relevance for the real estate assets

According to the Bond University, over 2/3 of real estate investors world-wide name location risk as critical for their business. Real estate is a financial asset and its value (along with performance) is typically determined by macro economic trends, regulatory (e.g. zoning), as well as urban development plans.

To avoid running chances and consider changes to the local context, property portfolios can be stratified by risk level. Understanding risk enables identification of assets to reprofile, lease or sell, and monitor. Such stratification is essential for banking and reinsurance pricing.

The core concept lying in the Habidatum’s risk assessment methodology is urban centralities[1] – a way to classify and rank locations based on the population analysis, their lifestyles, commercial diversity, transit flows, etc. Habidatum’s Centrality Index is calculated using data on people’s concentrations and the diversity of social and commercial services (or volumes of financial transactions).

Real estate risk scores may be obtained by overlaying assets on top of scored centralities. As a result, each real estate asset (or a solo location) gets a risk score which is a quick data argument for investment decisions: either you are searching for underpriced centralities with a high upside potential or benchmarking it against financial performance of the specific asset.

[1] See previous articles for the details.

Full analysis here.

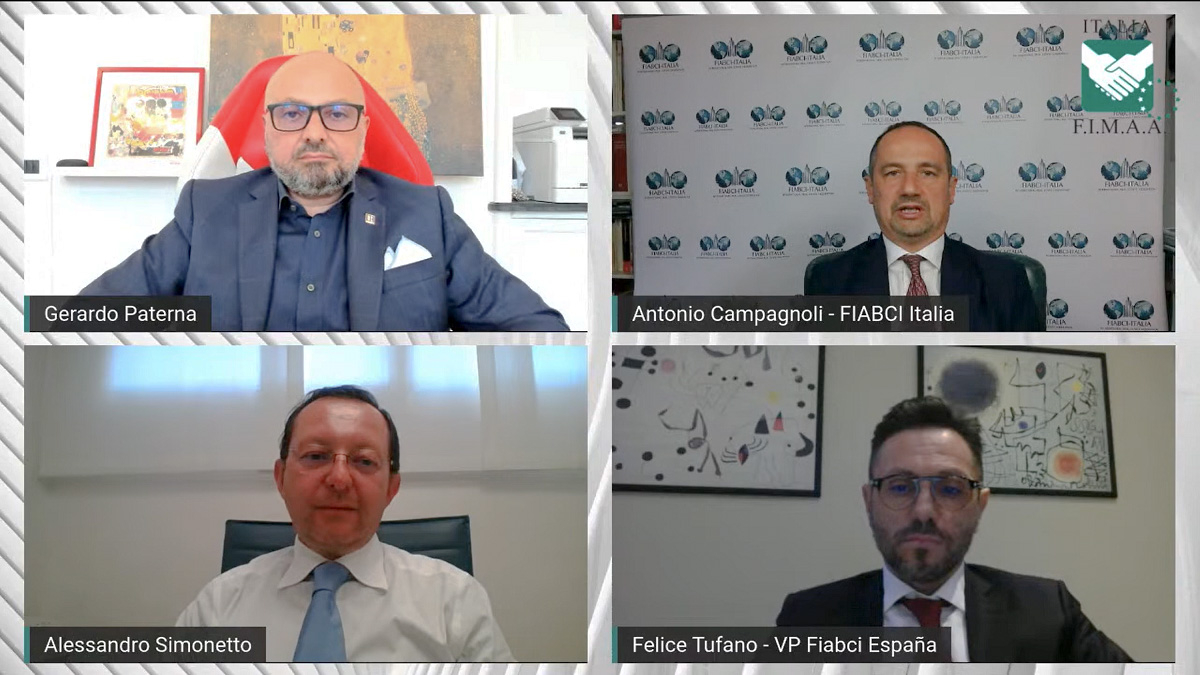

This analysis is part of a series of publications resulting from FIABCI's partnership with Habidatum.

About Habidatum

Habidatum is a software and data analytics company, assisting policymakers and businesses in understanding the hyper-dynamic urban environment through advanced analytics of diverse data sources driven by machine learning and interactive visualization.

Habidatum operates as a gateway between the professional communities who require data-driven insights and data carriers.

The company was founded in 2014 by a collaboration between professional urban planners and digital designers. Since 2014, the company has worked in more than 20 cities globally including London, New York, Moscow, Dubai, Singapore, Pune, Denver, and Miami.

![[Webinar Summary] COVID-19: What lies ahead for the Real Estate Industry?](/uploads/news/9i1w05plq2ksbcswuyj5ze2nr.png)