Real Estate Education Goes Global

The evolution of global real estate education over the past three decades will be integral to developing a rich pipeline of talent for the future of commercial real estate.

It is no surprise that global real estate education has increased in parallel with the growth of AFIRE over the past three decades. And as the academic focus on international real estate has evolved over this period, aided by a global mindset, and better access to technology and research, this changing landscape will be integral to the future of commercial real estate.

Based on these changes, it is exciting to observe that in recent years there is now a larger, focused academic interest in international real estate. A significant number of international students have come to the US to participate in advanced real estate programs, not available in their own countries. Students have also become very focused on ESG factors and how they can make an impact on real estate going forward. For example, in my course at Georgetown, I give my students a hypothetical US$100 million to invest on behalf of a US pension fund in building up a real estate portfolio in a country of their choice, diversified by real estate sector and geography, with an exit strategy as well as a separate hypothetical US$100 million back into the US, from an institution from that same overseas country. Their presentations have become increasingly more sophisticated over the years, as well, benefitted by increased access to technology and smarter tools for data analysis and visualization.

Much of this sophistication has also come directly from the business community of investors, especially at AFIRE. I am greatly and personally indebted to a great many guest lecturers over the years (a large number from AFIRE member organizations), who have been willing to come in person or online to speak to my students about their direct experiences working in international real estate—building a direct connection between the university and real-world practice. For example, in the early 2021 semester, we had a total of forty guest lecturers, with broad experience in international real estate, including developers, investors, appraisers, lawyers, and more. Five of the speakers will have been former students from the programs where I have taught, and over the time of my teaching, around a few dozen students have gone to work for the same companies welcomed into our classroom.

There is a direct connection between education in real estate and overall talent development in the industry.

A personal reflection

Since I came to the United States in 1977 after completing my MBA at INSEAD in France and was hired as the first International Investment Coordinator at Romanek Golub in Chicago, the growth of foreign investment in US real estate has multiplied many times over. Back in the 1970’s and 1980’s, investment was for foreign nationals coming to the US with advisors such as Jones Lang Wootton— now JLL and Richard Ellis, now part of CBRE—who brought European professional expertise to US, including a number who had trained as Chartered Surveyors. Although the real estate profession was offered at some universities in the UK, it was hardly taught in the US, with a few notable exceptions and in just a few programs at the graduate level.

Since the 1970’s, real estate programs have become a significant part of offerings at the Universities of Wisconsin, Pennsylvania, Denver, Southern California, Texas, Johns Hopkins, and MIT. They and others were examples of pioneers in their field of expertise, but mostly at undergraduate level. But even then, international real estate was not part of many of those curricula, though some programs in recent years have exposed students to international real estate meetings abroad, such as MIPIM and EXPO REAL, and some select associations, such as the Urban Land Institute and FIABCI, have offered mentoring, scholarships, internships, competitions, and exchanges, thus enhancing their international appeal.

What has changed in international real estate education?

When I started teaching this course in the late 1980’s international real estate investment was not the big factor in the investment market, but today, it is. The buyers were usually US investors and there were far fewer properties changing hands. Back in 1977, computers had not yet been embraced by the profession and many companies relied on real estate analysts to provide the numbers and research to justify the investments, with handheld HP calculators.

It was essential to travel to the location of the targeted properties and those like me spent a great deal of time on the road, visiting potential investments and trying to find sources to verify market data and justify the investment. In my case, I would spend one to three weeks per quarter overseas, communicating with the investors and presenting the case for investing in the respective properties. In the late 1970’s, it was the German and Dutch institutional investors who were the main source of international investment into the US.

As part of my own path into international real estate, I joined the Fédération Internationale des Administrateurs de Bien-Conselis Immobiliers (FIABCI, or the International Real Estate Federation) in 1979. Having lived and worked in the UK, Belgium, and France, it seemed like a logical parttime activity to expand my network by teaching the expertise from what had become my day job. FIABCI gave me the opportunity to network globally, and even though their focus became more residential than commercial.

I loved the educational aspect of the work, and soon grew into different roles as the FIABCI-USA President, FIABCI-UK President, and World President, to impart to others what is required to accomplish a real estate transaction across borders.

Today the international real estate profession is more sophisticated and offers opportunities for students to focus on different areas of growth and attraction for investors. Additionally,

technology has dramatically changed real estate investing in the last forty years, and today’s students have grown up and benefitted from a data-driven profession. The educator’s role has changed in kind, especially in the wake of the pandemic.

Additionally, some funds have historically determined they cannot acquire overseas unless the properties are physically inspected by one of their employees, which has meant potential new employment for new talent that may be based in those countries. There is thus a new and growing need for accomplished graduate students who understand the culture of the cross-border investor and can apply that knowledge to the local US real estate markets, to acquire, value, advise, recommend, asset manage, and, if necessary, oversee the sale of real estate assets for the foreign-based investor. This is how graduate global real estate students can and are filling this void, to their investor’s benefit.

Staying at the forefront of talent development

Though it is now one of many programs focused on international real estate, the graduate global real estate program at Georgetown University is very appreciative of AFIRE’s membership, which has, in turn, enabled expert knowledge being passed down to the students. It has also brought cutting-edge subjects, such as ESG and sustainable and social investing, to the forefront of global investment programs—in addition to a growing focus on proptech, bitcoin, and other technological and financial developments that have made global investing more efficient in recent years. Today’s students have grown up with these advances and can shift their graduate courses to make their educational experience that much more efficient.

As part of the association’s core mission, AFIRE has made a special effort to enable its membership to stay at the forefront of real estate invention, with links to graduate international real estate programs that have facilitated access to lectures, publications, and

potential employment—permanent and through internships—which has greatly enhanced the quality of talent recruitment by AFIRE’s members. It has indeed been encouraging to see former students rising quickly within member firms to take leading roles in leading their acquisition and asset management of their global portfolios, and lead the future of real estate.

By Julian Josephs, FRICS

Adjunct Professor

Graduate Global Real Estate Program Georgetown University

This article was originally published in the AFIRE Summit Journal (Issue #07) on July 14, 2021.

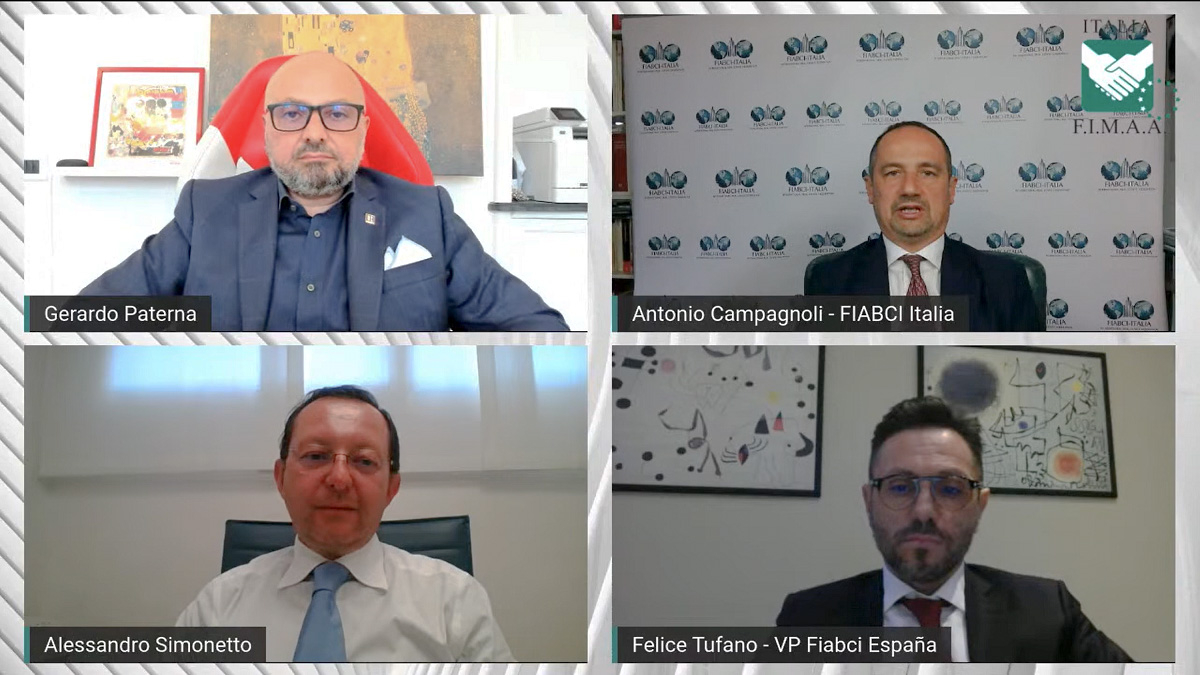

![[Webinar Summary] COVID-19: What lies ahead for the Real Estate Industry?](/uploads/news/9i1w05plq2ksbcswuyj5ze2nr.png)